Don’t Overlook these 2020 Tax Deductions. Last year brought lots of changes in the way we do things and especially how we work and care for our families. Stephanie Bateman has ‘Grouped’ a list of some of the deductions you may want to review before filing in 2020. Be sure to consult a tax professional to see if you qualify. Why not turn a tough year into tax savings?!

#1 Home Office Deductions

The biggest question when filing 2020 taxes may be, “Can I write off a home office due to work from home orders?”

Stephanie Bateman Group

Because of COVID-19, millions of people no longer go to the office but work from home instead, where they’ve had to set up workstations with desks, printers, high-speed internet and other pricey items — often paid for out of their own pockets. Can they deduct those expenses on their taxes?

COVID-19 has changed everything this year for American workers. Some changes have been good on the pocketbook, such as reduced expenses on commuting, lower auto insurance premiums and less money going toward work clothes and lunches. Others have presented some new financial challenges: things like higher utility expenses, buying a faster internet plan with a new Wi-Fi router to handle the upsized bandwidth, office furniture and equipment and anything else to enable your remote working. After the challenging year, it would be nice to know whether these expenses can at least be deducted on your tax return.

In short, your eligibility to claim these expenses as deductions largely comes down to one question: Are you an employee or an independent contractor? Sadly, for employees now forced to work from home, the Tax Cuts and Jobs Act of 2017 eliminated deductible expenses tied to maintaining a home office. On the other hand, independent contractors are in luck.

Employees Miss Out

After tax reform became law at the end of 2017, employees lost the ability to deduct expenses related to maintaining a home office. Previously, employees could claim an itemized deduction for unreimbursed business expenses that exceeded 2% of their adjusted gross income. This included any work-related expenses for business you conduct at home. For employees, those deductions are now gone.

Despite this unfavorable rule change, employees still need supplies and equipment to function effectively in their jobs at home. In a standard work environment, the employer provides these necessities. Now, many employees working from home will need to procure these items for themselves. If you find yourself in this situation, you face one of three outcomes with respect to the financial and related tax implications:

- Your employer purchases the items and provides them to you.

- You purchase items and receive reimbursement from your employer.

- You purchase items and do not receive reimbursement.

In the first situation, these items would qualify as an employer-owned supply and thus would be a deductible expense on their tax return. Assuming the employer provides these supplies and equipment for noncompensatory business reasons, employees will not need to pay taxes on these items. This includes items that employees may also have available for personal use, such as a cellphone or computer, because the IRS deems these as “de minimis fringe benefits.”

The second situation is similar. If the expenses count as “ordinary and necessary,” or those which your industry considers commonly accepted for conducting your trade or business, these reimbursements will not count as taxable income to the employee. To avoid having employees count these expenses as taxable income, employers should lay out an “accountable plan,” or a set of policies that state what qualifies for reimbursement when employees need to purchase supplies and equipment at home.

In the final situation, employees purchase the needed supplies and equipment but have no expectation of receiving reimbursement from their employers. Prior to the Tax Cuts and Jobs Act, if these expenses exceeded 2% of employees’ adjusted gross income, they could claim these deductions on their tax return. This would offset some of the expense picked up by employees. Unfortunately, that’s no longer true. No federal tax benefits exist at the moment.

Independent Contractors Get a Break

For independent contractors who buy home office equipment and supplies without being reimbursed, the tax picture is brighter. Independent contractors often have no expectation of reimbursement from their contracting company. As a result, people working in this capacity have access to self-employment tax deductions to lower their taxable income. They can also claim expenses such as depreciation on certain types of property, utilities, insurance and more.

In the event a company provides equipment to the independent contractor or reimburses expenses, these items would fall under the first and second situations above, respectively. This allows the company to claim these expenses as deductions on their business tax return, not the contractor.

Making a Home Office Deduction

The IRS has established a strict set of rules on home office deductions and too many taxpayers try to flaunt them. So unless you have a perverse love of audits, rein in your creativity on this one.

According to the IRS, a portion of following expenses may be deducted for a qualifying home office:

- Real estate taxes

- Mortgage interest

- Utilities (electricity, heat, water, gas, Internet service, telephone service, etc.)

- Insurance

- Painting and repairs

- Depreciation

Instead of itemizing, you can opt for taking a standard deduction of $5 per square foot of home office space, up to 300 square feet.

Again, the IRS is a stickler on this one. A qualifying home office is a part of the home that is used “exclusively and regularly” as the principle place of business [source: IRS]. Ideally, it’s a separate structure from the living quarters of the house. If not, then it needs to be a place set aside exclusively for business purposes. People get into trouble when their bedroom doubles as their graphic design studio, or they work from home a couple days a week because the commute is too long [source: Turbotax].

If you already have a portion of your home set aside exclusively for business purpose, then you have the right to take as many deductions as you deserve. For example, if you regularly meet clients or customers in your home office, you can deduct the cost of repairs and maintenance — even landscaping — to the home that make it more presentable. Source TurboTax

#2 Relocating to Pocket Tax Savings

Many workers have temporarily (or maybe permanently) fled expensive big cities for cheaper, more remote locations, often sporting lower taxes. What does that mean for their tax returns?

Given the fact that many people can work from anywhere these days, it might not be news that many people have decided to relocate from higher cost of living areas to cheaper areas. Doing so might allow you to keep more of what you make through lower costs or tax savings.

In the event you’ve decided to relocate permanently to a locale different from the one you started in 2020, you might face a complex tax situation come 2021.

If you’ve made a permanent move, you will need to file a tax return in both states this coming year. Going forward, you will only need to file a tax return in your new state as you would in any event where you move across state lines permanently. My wife and I relocated permanently prior to the pandemic, reasoning we stood to have a better quality of life elsewhere. In 2019, we paid state income taxes in Louisiana and California on account of living in both states a roughly equal amount of time during the year (we moved in mid-June 2019).

If you stay away longer than six months on a temporary relocation, you will likely face a tax obligation in your home state as well as your temporary location. That means you may be required to file tax returns in both states. You may want to consider consulting with a tax professional to understand the tax ramifications fully.

Given the substantial drops seen in tax revenues across the nation, states will be keeping a close eye out for people trying to game the system by claiming to have moved to a lower-tax state permanently or have chosen to make it their primary residence when they really haven’t. States look for definitive links connecting the state and the resident. Such examples could include individuals establishing residency, owning or leasing residential property assets that produced income, making money from a job, or engaging in some other financial arrangement tied to a location. Saying you have permanently relocated will require you to prove your change of scenery comes as more than just a transitory decision. Most locations will require you to document this change by living in your new location for at least 183 days. You can back this up by officially changing items like your voter registration and driver’s license.

Bottom line, because states will be keen to review any relocations, you will want to take extra precautions when it comes to legitimizing your relocation in the name of saving on taxes.

Now, if only employees could deduct those moving costs alongside their work-from-home related expenses. Sadly, tax reform put an end to claiming both as an employee.

Deducting Moving Expenses

The IRS applies two basic “tests” to determine if you can deduct moving expenses: distance and time. First, the distance test: If you move for a new job — or even to find a new job — the new location must be at least 50 miles (80 kilometers) farther than the distance of your old commute [source: IRS]. So if you used to drive 30 miles (48 kilometers) to work, the new location must be at least 80 miles (129 kilometers) from your old home. If you’re self-employed and work from home, then you only have to move 50 miles away, which can be as close as the neighboring city or town.

Now the time test: Once you move into your new location, you must be employed full time for at least 39 weeks of the next 12 months. What’s great about this is that you don’t have to work for the same company that brought you out to the new location. Even if you quit that job or get canned, you can still deduct the moving expenses if you get another job in the same geographical area that keeps you employed for the minimum 39 weeks. Note that if you’re self-employed, the time rule is more strict; you must remain employed full time for at least 78 weeks of the next 24 months after the move [source: IRS].

What exactly does the IRS let you deduct as moving expenses?

- Packing and shipping costs (moving company, for example)

- Up to 30 days of storage

- Travel to the new home including gas at $0.17 a mile

- Hotel rooms, but not meals

- Disconnecting utilities at the old home and connecting new ones [source: Turbotax].

The cool thing about moving expense deductions is that they’re an “above the line” deduction, meaning you don’t have to itemize deductions to claim them [source: Bischoff]. Now let’s look at some ways to get creative with education expenses.

#3 Charitable Causes

If you donate money to your church or another tax-exempt organization, you are allowed to deduct those cash donations from your taxable income. The same is true for non-cash donations like used items donated to Goodwill. But did you also know that you can deduct expenses incurred from volunteer work or other charitable activities? Thanks again, IRS!

Let’s say you mentor a kid across town as part of the Big Brothers, Big Sisters program. You drive 20 miles (32 kilometers) every week to meet him at his apartment. You buy reading and math workbooks to complete together. Every month, you take him to the museum or the zoo or a children’s music concert. You have kids of your own, and sometimes you pay a baby sitter to watch your own children while you mentor.

All of these out-of-pocket expenses support a volunteer activity with a tax-exempt charitable organization. So all of these expenses are deductible, including:

- Mileage to and from the mentoring appointments

- Books and other tutoring materials

- Tickets to museums, zoos and educational events

- Childcare expenses while you volunteer [source: Williams Accounting & Consulting].

Don’t let your charitable nature cheat you out of well-deserved tax deductions. If you really want to get creative, you can even deduct the expenses of the flour and sugar you buy to make cookies for the school or church bake sale fundraiser.

#4 Teacher Expenses | PPE

If you’re an eligible educator, you can deduct up to $250 ($500 if married filing jointly and both spouses are eligible educators, but not more than $250 each) of unreimbursed trade or business expenses. Qualified expenses are amounts you paid or incurred for participation in professional development courses, books, supplies, computer equipment (including related software and services), other equipment, and supplementary materials that you use in the classroom. For courses in health or physical education, the expenses for supplies must be for athletic supplies. Qualified expenses also include the amounts you paid or incurred after March 12, 2020, for personal protective equipment, disinfectant, and other supplies used for the prevention of the spread of coronavirus. This deduction is for expenses paid or incurred during the tax year. You claim the deduction on Form 1040, Form 1040-SR, or Form 1040-NR (attach Schedule 1 (Form 1040) PDF).

You’re an eligible educator if, for the tax year you’re a kindergarten through grade 12 teacher, instructor, counselor, principal or aide for at least 900 hours a school year in a school that provides elementary or secondary education as determined under state law.

#5 Stimulus Checks

Because of the severity of the national crisis, the government gave eligible Americans their tax credit early; the amount was based on their latest tax return filed or their federal benefits profile.

The IRS sent out about 160 million Economic Impact Payments, otherwise known as stimulus checks, last year.

For both the first and second stimulus checks, your adjusted gross income (AGI) determines the exact amount of your payment. Single filers with an AGI below $75,000 or single parents (heads of household) with an AGI below $112,500 are eligible for the full payment. Married couples who file jointly and have an AGI below $150,000 are eligible for the full payment.

Economic Relief Payments due to COVID 2020 phase out at a rate of $5 for each $100 over the AGI threshold. For the first round of checks, payments cease at an AGI of:

- $99,000 for single filers

- $136,500 for heads of household

- $198,000 for joint filers.

For the second round, payments cease at:

- $87,000 for single filers

- $124,500 for heads of household

- $174,000 for joint filers

Option 1, You Didn’t Get One

Some Americans inevitably fell through the cracks. If you didn’t get a first-round or second-round payment and should have, or received less money than you were entitled to, you will be able claim it on your 2020 taxes.

You can think of the payments already delivered as an estimate, based on the information available to the IRS at the time from your 2018 or 2019 tax return. Remember, they wanted to get the money into Americans’ accounts as quickly as possible.

Now you’ll be able to settle the score, as it were, by reporting your 2020 income and claiming the payments that you’re eligible for. The amount will lower your tax bill and may result in a cash refund.

Option 2, How to claim your stimulus check on your 2020 taxes

When you prepare your tax return, you’ll be asked to report the total Economic Impact Payment received to date.

There will be a separate worksheet on your tax return with instructions for calculating any outstanding amount owed to you, if anything. If you file your taxes using online software, the provider will prompt you to enter the required information and do the calculations for you.

The IRS advises filers to only fill out this portion of their return if they received less than the maximum payment amount. Anyone who received a first or second payment should have also received a letter in the mail — Notice 1444 — stating the exact amount.

If you do qualify for additional stimulus money, you won’t get it immediately. It will first be applied to your outstanding tax bill. If your bill is reduced to $0, the rest of the money will be added to your refund. The IRS delivers most refunds within three weeks.

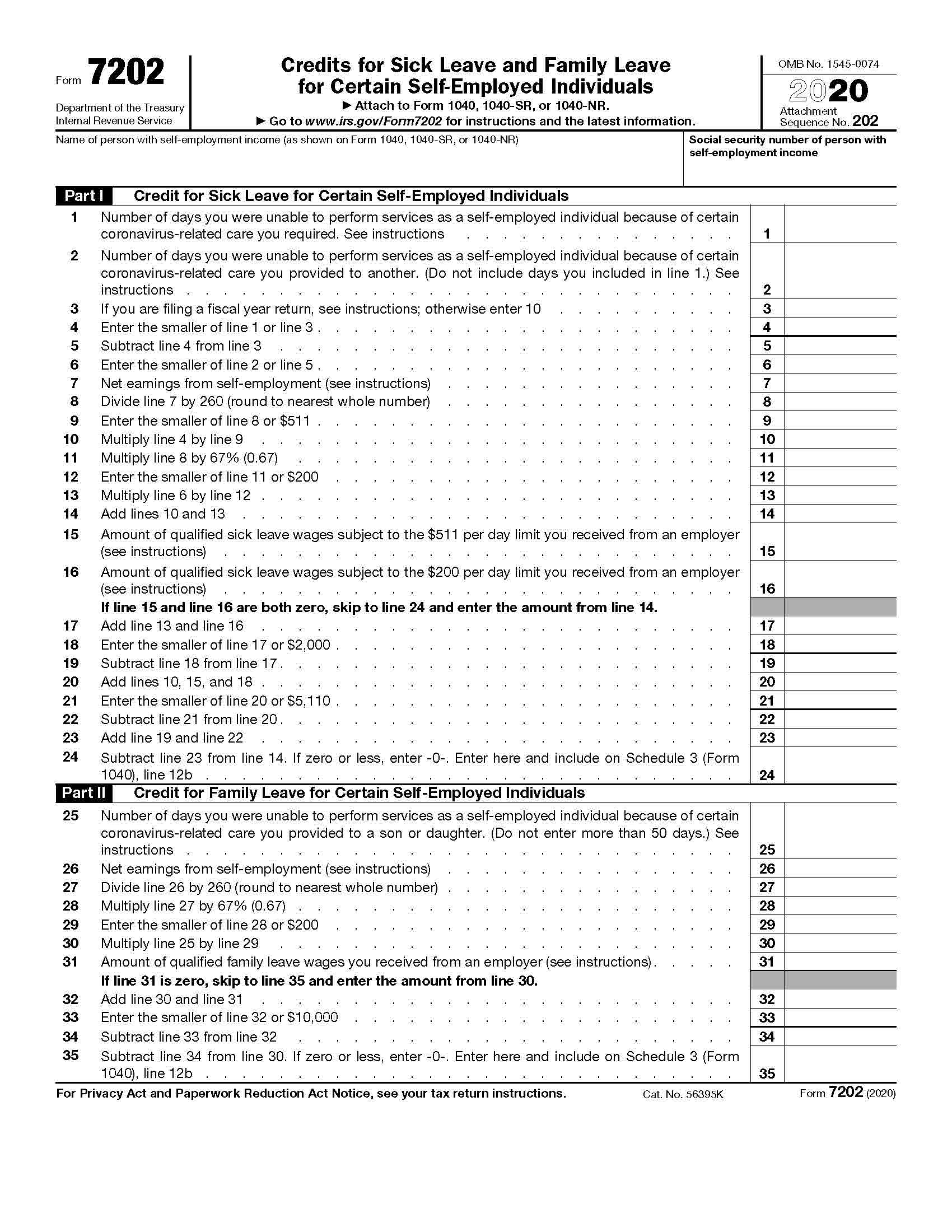

# 6 Missed Work Due to Quarantine or Closed Schools

In 2020, if you:

- Missed work to take care of kids because schools or daycare were closed

- Missed work to care for someone sick or quarantined

- Missed work because you were sick or quarantined due to COVID-19

- You’re self-employed

The IRS has a tax credit for you. You’ll need Form 7202, it’s for self-employed individuals to claim COVID sick and family leave tax credits under the FFRCA, Families First Coronavirus Response Act.

There are instructions on how to calculate the sick leave or family leave amount, but both the sick leave and family leave credits to start with a basic question: What is the number of days you were unable to perform services.

We advocate for more support for caregivers and more leave and this IRS tax credit is a version of that. We need to be able to recognize that financial loss when they’re self-employed and need to do some caregiving,”

Lisa Riegel, AARP NC Manager of Advocacy.

AARP estimated there are 1.3 million people who are caregivers for a family member and get no pay for it. AARP totaled up their estimated caregiving time to $13 billion in wages if they did get paid.

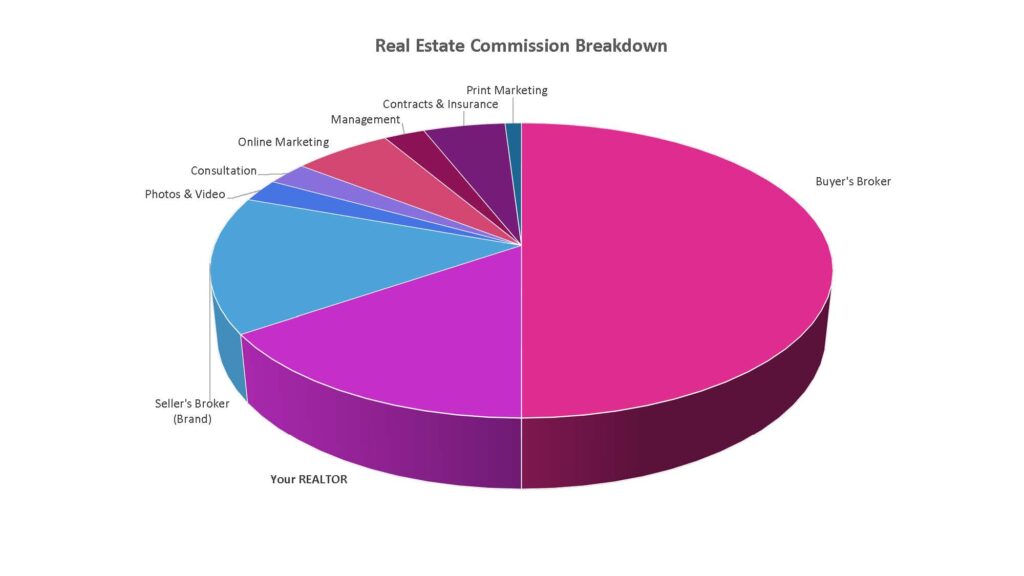

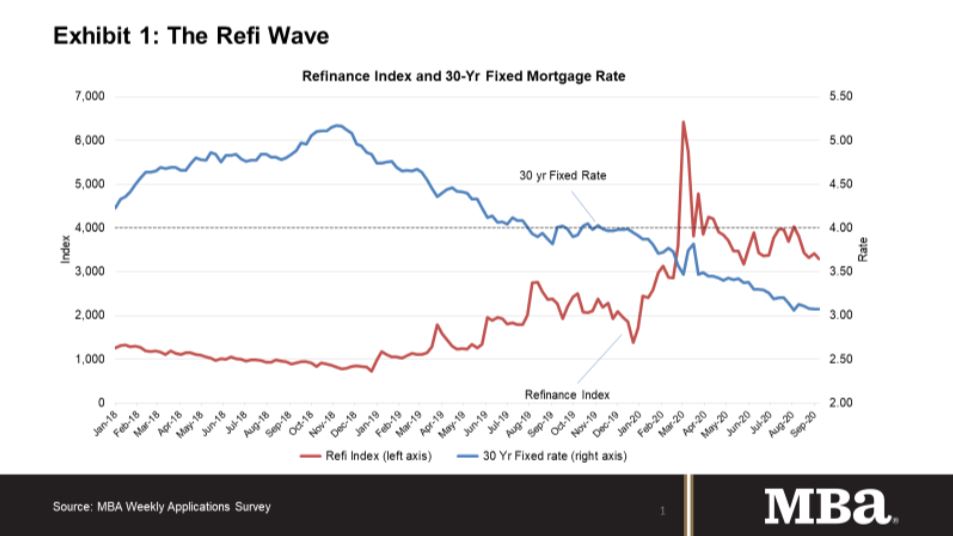

#7 Refinance Deductions

If you refinanced in 2020 to take advantage of historically low mortgage rates be sure to read this. The housing and mortgage markets have been the rare bright spots in an otherwise fragile economy brought forth by the ongoing COVID-19 pandemic. Mortgage origination volume this year is on track to be the highest in more than 15 years, led by a strong wave of refinances.

The Tax Cuts and Jobs Act of 2017 changed many of the rules for mortgage and refinance deductions. Understanding the new tax rules can help you minimize your tax burden after you refinance. We’ll talk about some of the deductions you can claim on your federal taxes after a refinance, and how long you can claim them.

The IRS doesn’t consider the cash from a cash-out refinance as income. Instead, they consider it to be a debt restructuring. This means that you don’t need to report any cash you take out of your home equity as income. The rules are a little different if you opt for a cash-out refinance. You may deduct the interest on your original loan balance no matter how much equity you take out of your home. However, you may do this only if you use the money to make capital improvements.

Mortgage Interest

Your mortgage lender will send you a document called Form 1098 at the beginning of each new tax year. This is your Mortgage Interest Statement, and it tells you exactly how much you paid in interest. You don’t need to include a copy of your Form 1098 with your tax return, but your lender is responsible for forwarding the IRS a copy. If you don’t receive a Form 1098 by mail or you have questions about the balance on your statement, contact your lender.

You can deduct any interest paid on your refinanced loan if all of the following conditions apply:

- The loan is for your primary residence or a second home that you don’t rent out.

- The lender that finances your home has a lien on your property. That means that if you fall behind on your payments, your lender can seize your property or put your loan into foreclosure.

- You itemize your tax return – we’ll go over more about what that means in a bit.

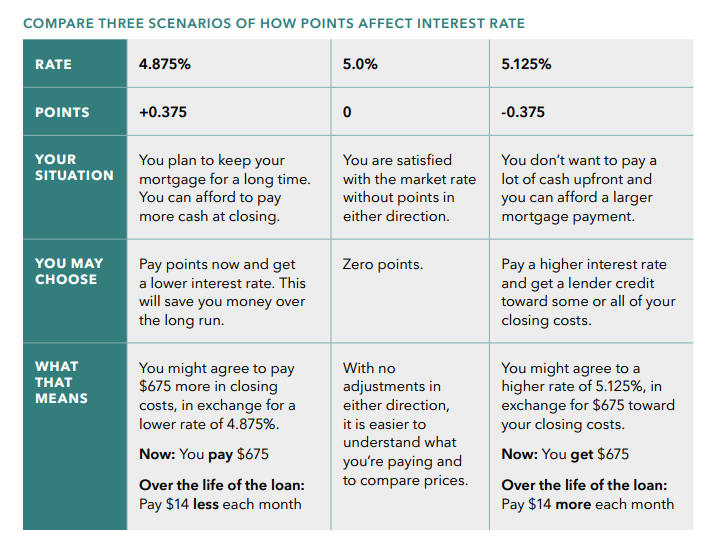

Discount Points

You may have the option to buy discount points when you close on your loan. Discount points reduce your interest rate. Each point costs 1% of your total loan value. For example, if you refinance a loan with a $150,000 principal, each point costs $1,500. You might hear a lender refer to this as “buying down” your interest rate.

Discount points are fully deductible, no matter which type of property you’re refinancing. You can also deduct discount points on both regular and cash-out refinances.

Closing Costs On A Rental Property

You cannot deduct settlement fees and other closing costs on a primary or secondary home. However, different rules apply for rental properties. The IRS sees the money you earn from renting out a home or condo as taxable income.

You have a lot more leeway when deducting closing costs and other upkeep expenses for a refinance on a rental property. Some expenses you can claim as deductions on a rental property include:

- Attorneys’ fees

- State-required inspection fees

- Refinance application fees

- Legal and recording fees

- Appraisal fees

In addition, you can also deduct insurance and repair expenses related to a rental property.

Mortgage Tax Deduction Restrictions

Keep in mind that most deductions only apply for homeowners who itemize their deductions. This means adding up all the individual deductions you qualify for and deducting them from your taxable income. You may choose to itemize your deductions or take the standard deduction. The standard deduction is a single deduction that anyone can claim, no questions asked. The standard deductions for 2019 are as follows:

- $12,200 for single filers

- $24,400 for married couples filing jointly

You cannot deduct things like interest and mortgage points if you take the standard deduction. This rule applies for both primary residence refinances as well as investment property deductions.

Summary

A deduction is a subtraction you can claim on your federal taxes that reduces your tax burden. There are a number of tax deductions that you can take advantage of if you refinance a mortgage loan. You can deduct the full amount of interest you pay on your loan in the last year if you did a standard refinance on a primary or secondary residence. You can only deduct 100% of your interest if you take a cash-out refinance, particularly if you use the money for a capital home improvement. Otherwise, you can only deduct the percentage of interest you paid on your original loan balance.

You can also deduct your discount points and any closing costs you pay toward a refinance on an investment property. You must spread these costs over the total term of your refinance and can only deduct these expenses if you itemize your deductions.