What are loan points and lender credits and how do they work?

Generally, loan points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. loan Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

These terms can sometimes be used to mean other things. “Points” is a term that mortgage lenders have used for many years. Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount, whether or not you receive a lower interest rate. Some lenders may also offer lender credits that are unconnected to the interest rate you pay – for example, as a temporary offer, or to compensate for a problem.

The information below refers to points and lender credits that are connected to your interest rate. If you’re considering paying points or receiving lender credits, always ask lenders to clarify what the impact on your interest rate will be.

Points

Points let you make a tradeoff between your upfront costs and your monthly payment. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

Points are calculated in relation to the loan amount. Each point equals one percent of the loan amount. For example, one point on a $100,000 loan would be one percent of the loan amount, or $1,000. Two points would be two percent of the loan amount, or $2,000. Points don’t have to be round numbers – you can pay 1.375 points ($1,375), 0.5 points ($500) or even 0.125 points ($125). The points are paid at closing and increase your closing costs.

Paying points lowers your interest rate relative to the interest rate you could get with a zero-point loan at the same lender. A loan with one point should have a lower interest rate than a loan with zero points, assuming both loans are offered by the same lender and are the same kind of loan.

Where Do I Find Points?

Points are listed on your Loan Estimate and on your Closing Disclosure on page 2, Section A. By law, points listed on your Loan Estimate and on your Closing Disclosure must be connected to a discounted interest rate.

The exact amount that your interest rate is reduced depends on the specific lender, the kind of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller. It depends on the specific lender, the kind of loan, and market conditions.

It’s also important to understand that a loan with one point at one lender may or may not have a lower interest rate than the same kind of loan with zero points at a different lender. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether you’re paying points or not. That’s why it pays to shop around for your mortgage.

Lender credits

Lender credits work the same way as points, but in reverse. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate.

Lender credits are calculated the same way as points, and may appear on lenders’ worksheets as negative points. For example, a lender credit of $1,000 on a $100,000 loan might be described as negative one point (because $1,000 is one percent of $100,000).

That $1,000 will appear as a negative number as part of the Lender Credits line item on page 2, Section J of your Loan Estimate or Closing Disclosure. The lender credit offsets your closing costs and lowers the amount you have to pay at closing.

In exchange for the lender credit, you will pay a higher interest rate than what you would have received with the same lender, for the same kind of loan, without lender credits. The more lender credits you receive, the higher your rate will be.

The exact increase in your interest rate depends on the specific lender, the kind of loan, and the overall mortgage market. Sometimes, you may receive a relatively large lender credit for each 0.125% increase in your interest rate paid. Other times, the lender credit you receive per 0.125% increase in your interest rate may be smaller.

A loan with a one-percent lender credit at one lender may or may not have a higher interest rate than the same kind of loan with no lender credits at a different lender. Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders – regardless of whether or not you’re receiving lender credits.

See an example

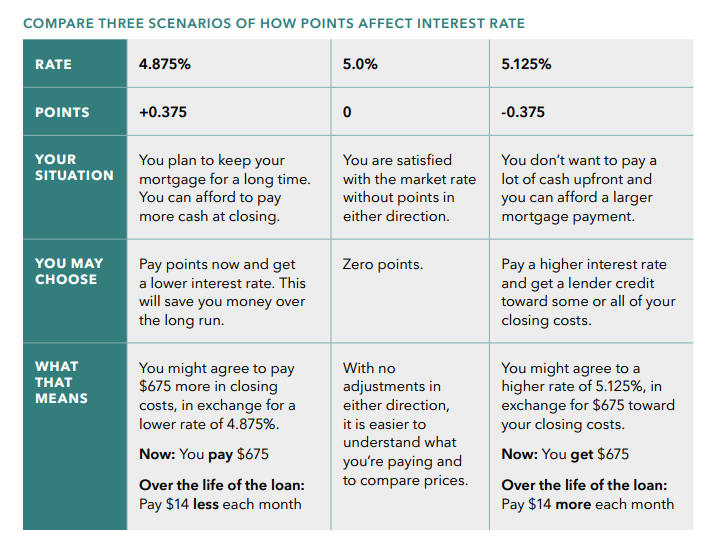

The chart below shows an example of the tradeoffs you can make with points and credits. In the example, you borrow $180,000 and qualify for a 30-year fixed-rate loan at an interest rate of 5.0% with zero points. In the first column, you choose to pay points to reduce your rate. In third column, you choose to receive lender credits to reduce your closing costs. In the middle column, you do neither.

Tip: If you don’t know how long you’ll stay in the home or when you’ll want to refinance and you have enough cash for closing and savings, you might not want to pay points to reduce your interest rate, or take a higher interest rate to receive credits. If you are unsure, ask a loan officer to show you two different options (with and without points or credits) and to calculate the total costs over a few different possible timeframes. Choose the shortest amount of time, the longest amount of time, and the most likely amount of time you can see yourself keeping the loan.

When comparing offers from different lenders, ask for the same amount of points or credits from each lender.

Consumer Finance

How can we help?

Have questions? Want to discuss your current home? Looking for a new home? Give us a call! Our real estate services are client focused with one-on-one support. We have teamed up with top brands in photography, web hosting, property search & management to offer you the best in real estate services, all in one place.

Stephanie Bateman Group

Houston, Texas

(713) 383 – 8672

Hours

Monday – Friday: 8am – 6pm

Saturday – Sunday: By Appointment